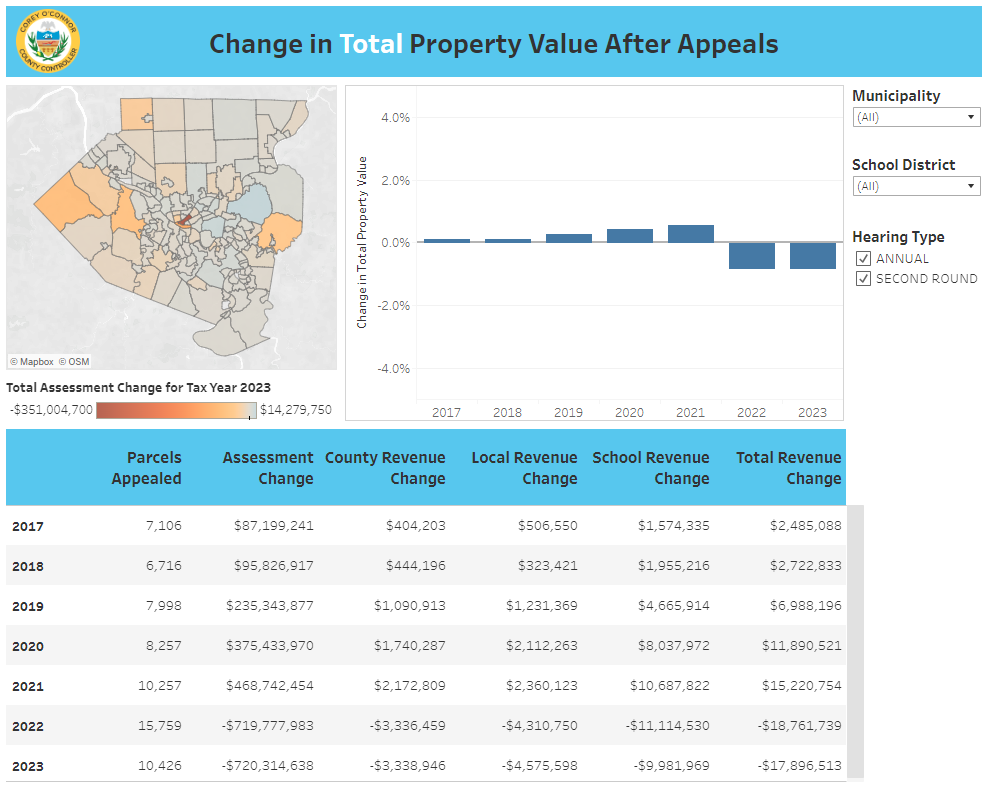

A new interactive online dashboard developed by the office of Allegheny County Controller Corey O’Connor shows changes in property assessment valuations over recent years, particularly highlighting reductions since a court-ordered change in how values are calculated.

The change to the Common Level Ratio (CLR) which is used to assign taxable values has resulted in a surge of appeals from property owners. Appeals by large commercial properties that have lost tenants since the COVID-19 pandemic have been particularly impactful on overall property values in several municipalities, which reduces the funds the County, municipalities and school districts can derive from property taxes.

To cite the most glaring example, properties in the City of Pittsburgh’s Ward 2 in Downtown saw assessment reductions of over $350 million based on 2023 appeals.

“Property taxes are the lifeblood of our local governments and school districts, and these entities are severely limited in their other options to raise revenue. The recent changes in how property values are calculated and the large number of appeals that has resulted presents a challenge to these taxing bodies, including Allegheny County,” O’Connor said. “I think our dashboard can be a valuable tool in helping policy makers to see these impacts and help all residents understand the challenging discussions that are likely be upcoming regarding revenue for our local governments.”

Dashboard users can narrow results to see changes by school district, municipality, or City of Pittsburgh ward. Results can be seen for residential or commercial properties only, or for all properties. Individual commercial properties in Downtown Pittsburgh which have seen large changes in valuation are also shown.

Along with the new dashboard, the Controller’s Office website offers a Property Tax Estimate Worksheet which can help property owners determine if they may benefit from an appeal, and an Assessment Appeals Guide outlining the process of appealing a property tax assessment.

“My office is committed to making government as accessible as possible to all residents. With these tools, I think we are shedding new light on government processes that many residents have previously been in the dark about,” O’Connor said.